capital gains tax changes canada

The applicable rate is half 12 of the income tax rate which is 12 for individuals and companies after the changes to the tax code from 1 October 2018. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Recent State Tax Changes.

. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. Heres a sample computation of capital gains tax on sale of property.

In Canada 50 of the value of any capital gains are taxable. If you have more than 3000 in capital losses this excess amount can be carried forward to future years to similarly offset capital gains or other income in those years. However the CRA recognizes that property owners may face difficulty paying capital gains tax when a sale has not occurred.

The capital gains tax is economically senseless. If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

If the capital gains are realized by the. The Taxpayer Relief Act of 1997 PubL. 50000 - 20000 30000 long-term capital gains.

Guide T4036 Rental Income. In this regard anything you do to transfer it to your son now will be income tax-free but it. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels.

A principal residence is tax-free for capital gains tax purposes upon sale or upon death. Guide T4037 Capital Gains. Guide T4002 Self-employed Business Professional Commission Farming and Fishing Income.

Estate and Gift Taxes. The same rules apply in the case of a change of use ie. Youd have to pay capital gains tax on the 60000 profit you made from that sale.

While this re-characterization of capital gain to ordinary income under IRC section 751 changes the rate of taxation for federal tax purposes it does not require a bifurcation of the sale into two separate transactions nor does it necessitate a recasting of nonbusiness income into business income. This concept is referred to as the tax integration cost However with changes to the rules governing the taxation of dividends in 2006 and the gradual reductions to the federal and some provincial general corporate tax rates the cost of retaining income within a corporation has declined. The top marginal long term capital gains rate fell.

This credit was phased out for high-income families. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. 787 enacted August 5 1997 reduced several federal taxes in the United States.

Form T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual. Multiple ways are available to. The CRA is factoring in this heightened inflation to bring big 2022 tax breaks.

In the case of a true sale of an investment property capital gains tax must be paid when you file your tax return for the year the sale occurred. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. Starting in 1998 a 400 tax credit for each child under age 17 was introduced which was later increased to 500 in 1999.

In most of the cases the available time limit is longer and sometimes. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the. To encourage the reinvestment of the capital gains that are made on the sale of the capital assets through the seller the Indian government has given the relief from the tax of the capital gains if such capital gains are reinvested in some specific assets in a mentioned time limit.

To be clear this money isnt a. So if you end up selling a rental property in Kingston Ont. 132 The capital gains and capital losses referred to in 127 do not include certain capital gains and capital losses that pursuant to paragraph 4031a and subsection 40312 arise from the deemed disposition of a members interest as.

Short-term gains come from the sale of property owned one year or less and are typically taxed at your maximum tax rate as high as 37 in 2021. That means your investments can grow and you dont have to worry about changes in value until you. Income Tax Rates and Brackets.

Capital Gains and Dividends Taxes. On the other hand if the current fair market value of the property amounts to Php 2800000 and not Php 2400000 then the total capital gains tax for the. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937.

Expenditures Credits and Deductions. The tax law divides capital gains into two main classes determined by the calendar. Canada reported its highest inflation in 18 years.

Capital Gains Tax Rate. Capital Gains Account Scheme. Thus the current capital gains tax is 6 for both individuals.

Understanding Capital Gains Tax In Canada

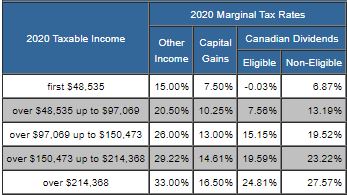

Taxtips Ca Federal 2019 2020 Income Tax Rates

Canada Capital Gains Tax Calculator 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

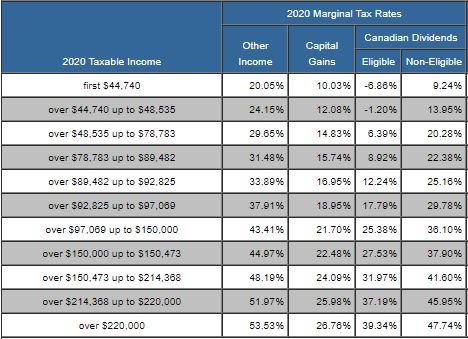

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Capital Gains Tax In Canada Explained

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Capital Gains Tax In Canada Explained Youtube

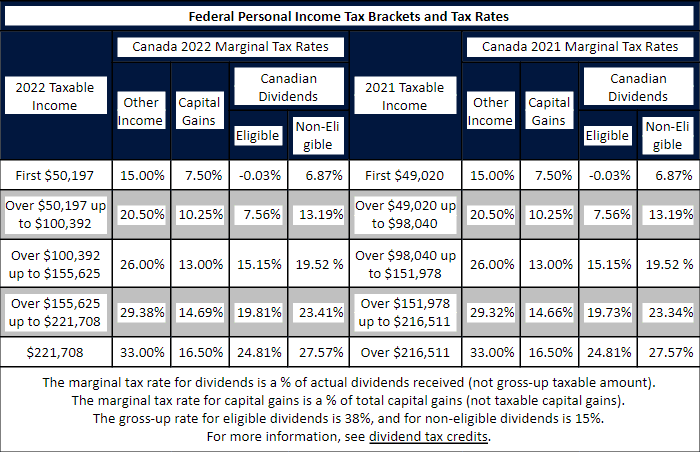

Tax Brackets Canada 2022 Filing Taxes

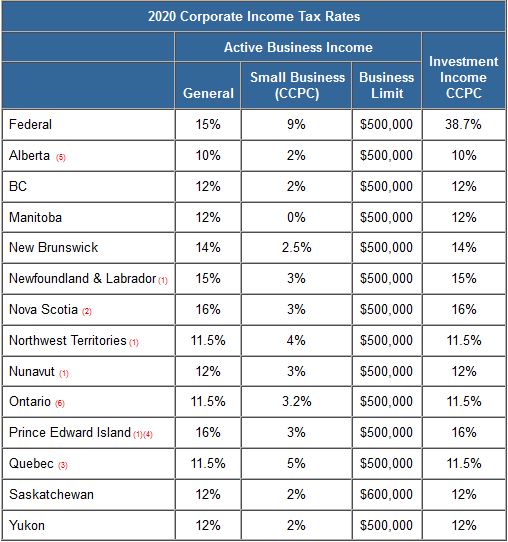

Taxtips Ca Business 2020 Corporate Income Tax Rates

Understanding Capital Gains Tax In Canada

Understanding Taxes And Your Investments

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca